It’s time for a European Cleantech Investment Plan

In October 2023, the European Commission put forward a Communication taking stock of its policy initiatives to support the deployment of clean technologies (cleantech). In this Communication one thing that is striking is the mention of the cleantech investment plans global peers such as the US, China, Canada and Japan have in place.

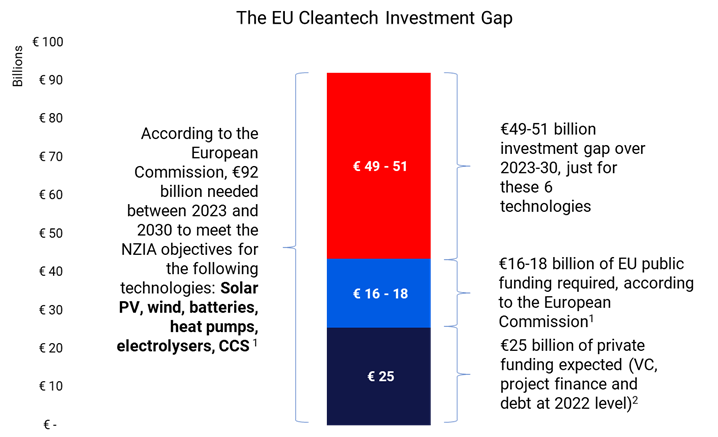

This observation is striking for two reasons. First, although Europe was the global frontrunner in climate policy, it has not thus far put forward a simple and predictable investment plan on how the technologies needed for the bloc to reach net zero by 2050 will be financed. Second, Europe will be experiencing a €50 billion investment gap just to scale six net zero technologies until 2030 under the Net Zero Industry Act (NZIA), the key regulatory tool to ramping up cleantech manufacturing in the EU.

The investment gap

The anatomy of the investment gap

In January 2020, the European Commission unveiled the European Green Deal Investment Plan (Plan). The Plan put forward three key actions to mobilise at least €1 trillion to support sustainable investments over the next decade. These are: (1) increase funding for the transition through the EU budget and EU financial instruments; (2) develop a regulatory framework to spur sustainable investments; and (3) support public administrations and project promoters in identifying, structuring and executing sustainable projects.

Three years later the European Commission unveiled a second plan, the Green Deal Industrial Plan, which aims to support the overall scale-up of cleantech deployment and enhance Europe’s competitiveness in research and manufacturing of these products. One of the pillars of the Green Deal Industrial Plan concerned faster access to funding for cleantech projects by tweaking State aid rules to allow for easier access to subsidies and repurposing of existing funding under REPowerEU, the InvestEU Programme and the Innovation Fund.

While all these steps are promising, they cannot deliver the magnitude of investments we need to catalyse cleantech manufacturing in Europe and reach our green industrial ambitions. Why?

First, these plans have not yet provided enough upfront CAPEX financing to ‘put shovels in the ground.’ Cleantech projects often have very high CAPEX and low OPEX dynamics relative to many of the incumbent industries, requiring a support framework that reflects these characteristics. The recent case of H2 Green Steel, a Swedish start-up company, which raised €4.2 billion in debt financing to build the world’s first large-scale green steel plant is the exception and not the norm in Europe.

Second, none of these plans focus on unlocking the big private pockets of money that can be a game-changer for cleantech, namely pension funds and insurance companies. In the US, insurers and pension funds are the key funders of cleantech venture capital (VC) firms that in turn channel funding to cleantech companies. In Europe, that is not the case. For instance, EU pension funds in 2021 invested less than 0.018% of their total assets in venture funds, while in the US public pension funds invest 1.9% of their assets in venture funds. Most recently, the fund Teachers’ Venture Growth (TVG), part of the $250 billion Ontario Teachers’ Pension Plan, invested in Instagrid’s series C funding round, a German off-grid portable battery systems company, to expand its operations in North America.

Bridging the gap

With climate time not being Europe’s time, there is still a window of opportunity for Europe to usher in a new green industrial era and stay in the global cleantech race. This is why putting in place a public sector-enabled, private-sector-led European Cleantech Investment Plan can deliver a clear business case for European cleantech companies and unlock significant funding to help them scale.

The three pillars of a ‘European Cleantech Investment Plan’

Incentivize institutional investors to invest in cleantech

In the European Economic Area, in Q1 2023, (re)insurers held €8.57 trillion in assets while pension funds held approximately €2.4 trillion in Q3 2023. Due to the size of their balance sheets, insurers and pension funds are prime candidates to unleash the capital we need to scale European cleantech.

So, what holds both pension funds and insurers back from investing in cleantech? Four barriers: (i) prudential rules; (ii) the perceived high-risk nature of cleantech investments; (iii) minimum ticket sizes of cleantech funds; (iv) prudential rules do not encourage cleantech investments. What can we do to lift these barriers? Four things: (1) accelerating regulatory changes to lift barriers to cleantech investment; (2) developing fund-of-fund initiatives (investment strategy where a fund invests in other funds rather than investing directly in stocks, bonds, or other securities) and first-loss mechanisms; (3) creating a high-level dialogue between policymakers, institutional investors and cleantech manufacturers to align and get to the next level; (4) launch an EU-wide awareness initiative regarding the performance of European cleantech venture capital to present successful made-in Europe cleantech companies

Mobilise public guarantees to catalyse private investment

Cleantech companies have a hard time financing their first-of-a-kind projects via commercial loans. What’s more, when selling innovative equipment, cleantech manufacturers are asked for a series of bank guarantees, to mitigate the buyer’s risks in purchasing this equipment. Because of their lower bankability compared to industrial incumbents, innovators are not able to finance these guarantees at a reasonable cost. This ties up precious working capital in collateral that could be used to ramp up manufacturing capacity.

An EU public counter-guarantee instrument could step in to take some of the counterparty risk from banks, allowing scale-ups to respond to high traction and build more plants and equipment faster, creating jobs and meeting the EU’s climate and industrial ambitions.

Mobilise revenues from the EU Emissions Trading System (EU ETS) to scale up cleantech manufacturing

One significant – and growing – pool of capital the EU could leverage further is ETS revenues. In 2022, total auctioning revenues generated under the EU ETS system were of a magnitude of €38.8 billion of which €29.7 billion went directly to Member States. From the remaining revenues, €3.2 billion went to the Innovation Fund. Given that these revenue streams are large enough for Europe to compete with global peers, the EU could consider front-loading cleantech investment, for instance by borrowing against future ETS revenues to invest in manufacturing capacity now. For this, EU policymakers can look to Japan’s plan to release ¥20 trillion (€127 billion) in transition bonds, the so called GX bonds, to catalyze public and private spending investments of ¥150 trillion (€955 billion) to scale clean technologies.

With the global cleantech competition ramping up and a new institutional mandate about to start in a few months, Europe has to ask itself in what it wants to be competitive. If the answer to that question is being the permanent home of cleantech innovation, then there is no better time than the present to set forth an ambitious and fiscally efficient Cleantech Investment Plan.

The author

Sofia is an EU-qualified lawyer and is currently the Policy Lead for Cleantech for Europe initiative. Previously, Sofia worked on EU climate and financial policy matters with a leading US international law firm in Brussels. Sofia is passionate about diversity and inclusion and has co-founded two initiatives focusing on women’s economic empowerment.

Related contents

Stay in the know

Get the Lights on Women newsletter.